The small caps have had a drastic correction this last year and are now signalling an upward move.

Managing individual small cap stocks needs active monitoring are unsuitable for the casual investor (meaning almost everybody!).

Then the alternative is to buy a Small Cap Fund. The ICICI Prudential Smallcap Fund – Retail – Growth is a good option – with a SIP rather than a lump sum (which they have just opened). If you have money to spare, however, a small lump sum bet would also be good.

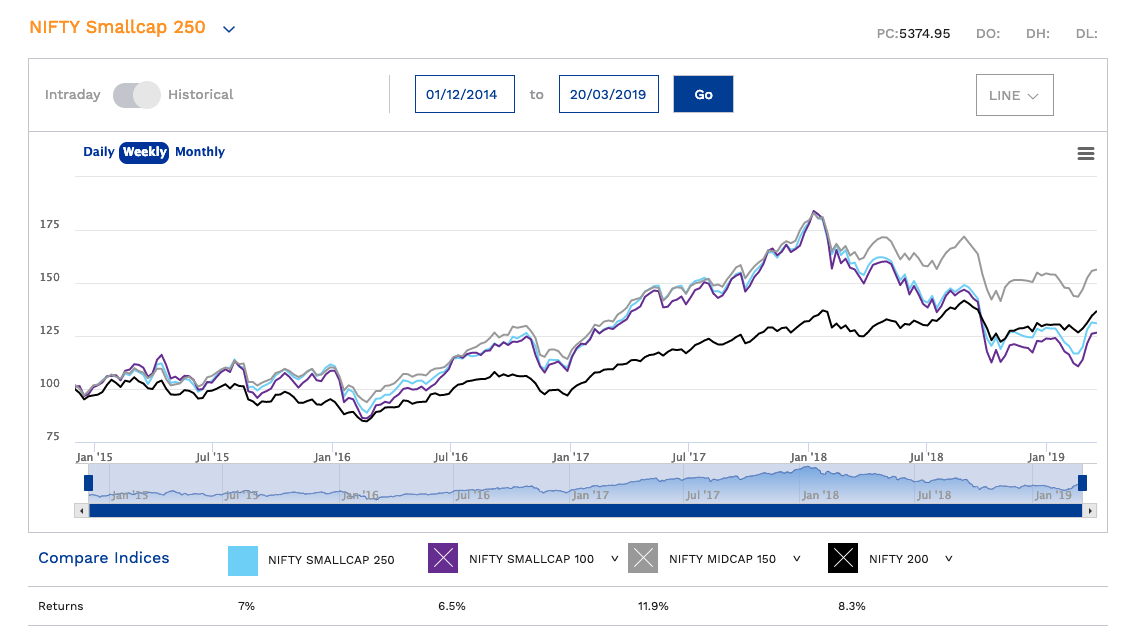

The indices speak for themselves in the comparative charts below:

Small Caps having corrected sharply, as you can see in the chart above, you can expect it give good returns over the next 1-3 years. The economy has settled down and baring unforeseen global uncertainty due to things like war or trade wars being unleashed, the small caps are most likely to give superior returns.

Now is the time for casual LT investors to start SIPs in small-cap mutual funds. With a 3 year horizon, it should give superior returns.

Tw: @jsvasan