FAQ on my preferences

Some other Testimonials are here.

Meet JS – A Life Well-Lived, Still Full of Purpose

JS is not your average 76-year-old. A vibrant life coach, JS blends wisdom with warmth, and a dash of sharp wit. Based in Bangalore, India, JS has worn many hats—athlete, educator, investor, traveler, and guide to many souls on their path to recovery.

A proud nationalist Indian, JS is a Hindu married to a devout Catholic—proof that love and respect cross all borders. A diabetic since 1992, he manages his health with tablets, insulin, and sheer willpower.

Sports? JS has been a powerhouse—representing college in six sports and university in three. World traveler? Absolutely—having explored every corner of India and much of the world. Since 1984, he has also run de-addiction workshops—pro bono, from the heart.

On the financial front, JS is an active participant in the stock market. But more than numbers, he invests in people—helping others grow through coaching, drawing from a lifetime of experience.

JS isn’t just living a life—he’s inspiring one.

Education

M B A : 1970 – 1972: Indian Institute of Management, Ahmedabad, India

- Merit Scholarship

- Majored: Finance & Marketing

- Student Associate, IIMA Computer Center

- Student Representative

- Summer Job: Indian Space Research Organisation (ISRO)

- Written Analysis & Communications

B.E. (Mech) : 1965 – 1970: University of Madras.

- Majored: Mechanical Engineering

- Student Representative

- Captain College Table Tennis team

- Played for college: Hockey, Cricket, 100mtr sprint

- Also played: Basketball, Tennis, Roller Skating

- College photography club

ISC : 1962 – 1965 : Indian School Certificate

[same as “O” levels, Cambridge Univ]

Captain: Table Tennis

School Team: Cricket, Hockey, Football & Sprints

Also: Swimming, Basketball, Shuttle Badminton

Class Monitor, final year

Skills & Experience

Designed and implemented IT systems.

Website Building

Advanced IT & Communications Architecture

Plan extensive projects with minute detail

Extensive use of Information Technology Tools to plan, monitor, control and implement large & complicated projects from conception to commercial output.

Complete co-ordination vis-à-vis legal and statutory compliance at each stage of the project implementation

Media relations & PR

Advertising campaigns

Communications campaigns

Website content

Product Management

Planning, Establishment, and operating facilities.

Distributed Manufacturing

Security systems

Recruitment

Remuneration planning

Training

Motivation and other modern HRD practices

Portfolio Management

Financial planning and design of information & control systems

Project Funding

Incorporation, Returns and Statutory compliance of the Companies Act with the Registrar of Companies, Company Law Board, etc.

Public Issue (Floatation) – SEBI approvals, dealing with Merchant Bankers, Listing in Stock Exchanges, returns and compliance with the Listing Agreements, etc.

Income Tax Act

Finalisation, Audit & AGMs. Design accounting systems to provide enabling MIS to top management, finalise accounts with Auditors, plan and conduct AGMs.

Indirect Taxes: Central Excise, Sales Tax. Completely familiar with the Central Excise Act, Central and Most State Sales Tax Acts. Can produce pricing and discount distribution policy

Factories Act. Payment of Bonus Act, Labour Laws, etc.

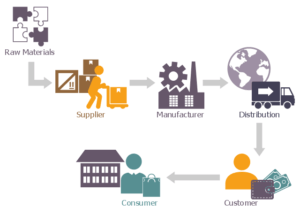

Vendor development

Procurement

JIT supply chain management

Cost control, Value Engineering

TQM methods