Unitech has been in the news for all the wrong reasons. Sure, the company has challenges. Then why is there concerted accumulation of the stock for quite some time now?

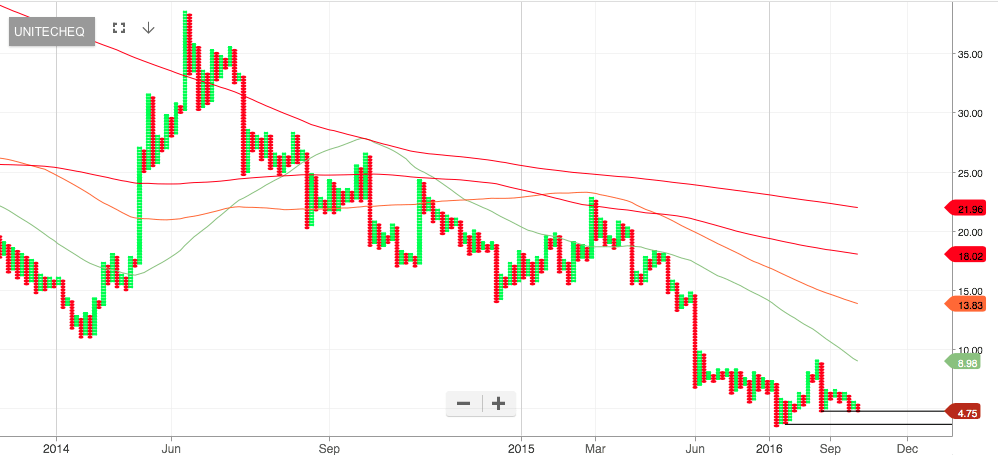

The stock is trading at Rs 4.75 now (Nov 15, 2016). It saw Rs. 380+ in it’s heyday. A company that is not an insignificant player in the housing market, Unitech has a lot to correct in it’s management, let alone it’s practices. It’s also a candidate for takeover or merger – a consolidation move that’s been long coming to the housing sector.

Multibaggers aren’t going to be found in the “A” stocks. No doubt, they’re not going to be found in stocks that have lousy management (like Unitech).

Then why am I suggesting the stock as a potential multi bagger?

- At Rs. 4.75, it’s downside is practically nil.

- The housing sector will boom with the huge shortage in housing in a booming India that’s predicted now more than ever after demonetisation.

- Unitech will either rebound after “hitting bottom”, or will be a target of some M7A activity.

- The concerted accumulation of the stock lends credence to (3) above.

- Multibaggers are never a “sure shot”!

The way for the common investor (not trader) to latch on to a multi bagger is to place small bets that yield extraordinary returns but carry low downside risks.

Unitech is a sizeable player in the brick-and-mortar world (pun intended). The bean counters may say the net worth isn’t rising. But that’s the same as what was said about the Indian Railways too, some years ago! Just the real estate that the Railways has (like Unitech) is becoming increasingly valuable. Other players in the sector are bound to find value in a takeover or merger – sooner or later!

The value of the stock in the merged/new entity will obviously shoot up from the measly Rs. 4.75 that Unitech trades at today.